Technical Timing Patterns – David Elliott

Download Technical Timing Patterns – David Elliott on Avaicourse.com

This course is available immediately. Please contact us at avaicourse17@gmail.com with the best service for more detailed advice.

Description:

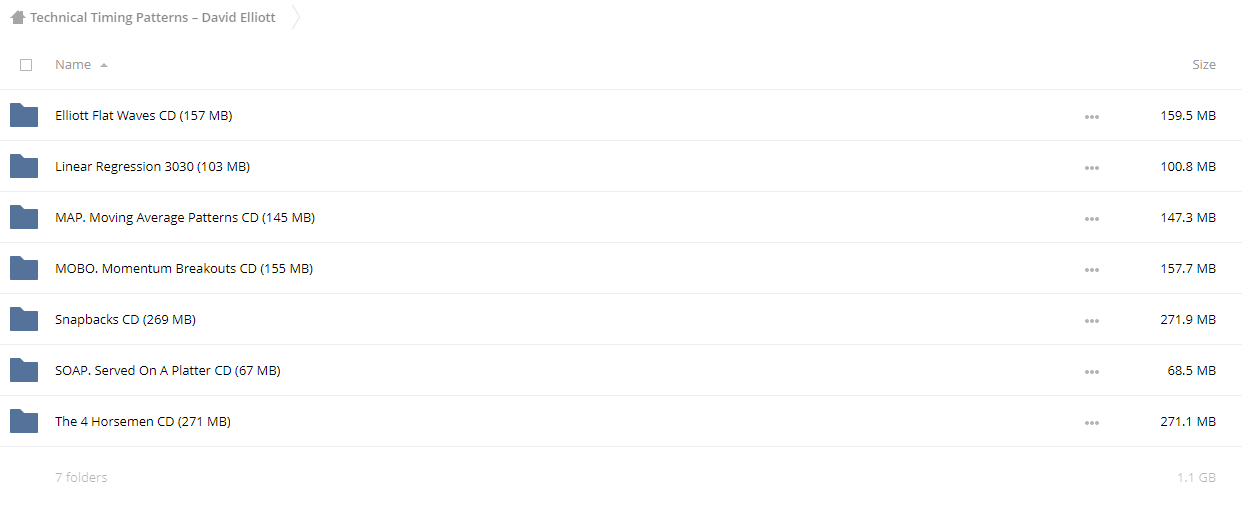

David Elliott – SOAP. Served On A Platter CD

David Elliott – MOBO. Momentum Breakouts CD

David Elliott – MAP. Moving Average Patterns CD

David Elliott – Elliott Flat Waves CD

David Elliott – Snapbacks CD

David Elliott – Linear Regression 3030

David Elliott – The 4 Horsemen CD

SOAP (Served On A Platter)

The SOAP pattern identifies the high probability of price tops and bottoms on any time period. It is useful in eliminating false buy and sell signals. This concept takes a short-term and medium-term Stochastic, strips off the SD from each of the SKs, and then re-combines the two SK stochastics to give us pure stochastic crossovers.

MOBO (Momentum Breakouts)

Price momentum breakouts give us buy and sell signals.

We get buy and sell signals from price Momentum Breakouts by modifying a standard deviation study to show us when “A” stocks breakout to the upside and when “F” stocks breakout to the down side.

We can also adapt the MOBO settings to other technical indicators for entry and exit signals on any time period.

MAP (Moving Average Patterns)

Predictable price behaviors occur around the four major moving averages.

On May 26th, 1896 Charles Dow introduced the industrial average, the Dow Jones 30. Since then there has been a repeatable and predictable price behavior pattern around the four major moving averages and this index. We do away with moving average crossovers, and switch to using a behavioral price pattern to find entry and exit prices, while investing in stock, futures, and indexes on all time periods.

Elliott Flat Waves

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Simplercourses – Bread & Butter Butterflies Class

Course Features

- Lectures 0

- Quizzes 0

- Duration 50 hours

- Skill level All levels

- Language English

- Students 0

- Assessments Yes