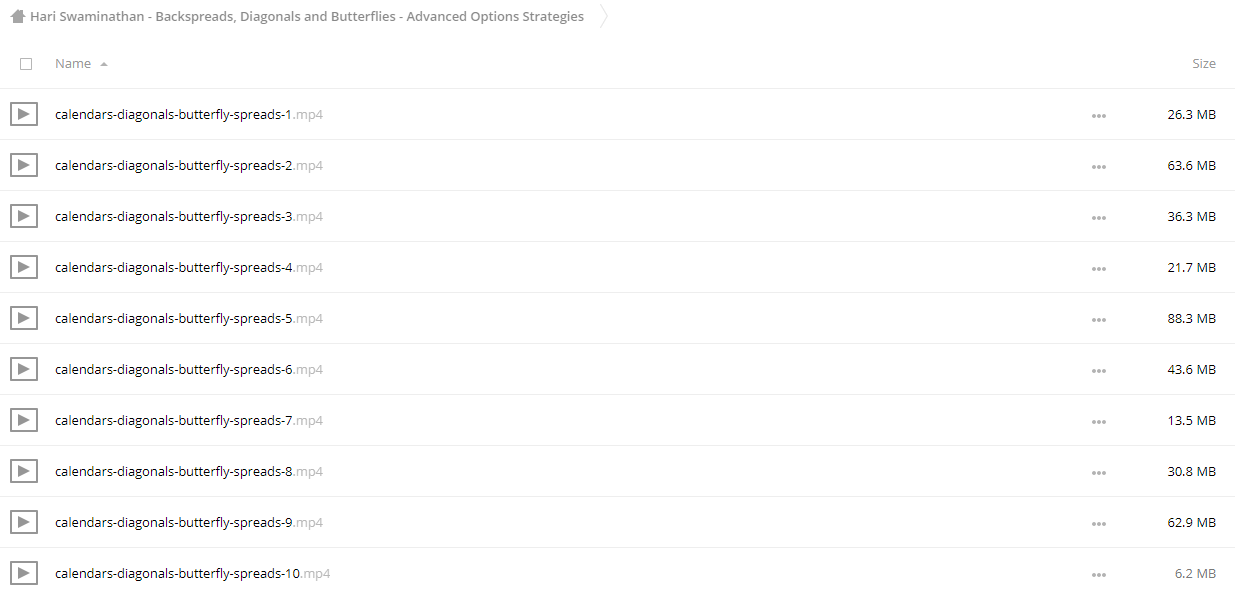

Hari Swaminathan – Backspreads, Diagonals and Butterflies – Advanced Options Strategies

Download Hari Swaminathan – Backspreads, Diagonals and Butterflies – Advanced Options Strategies on Avaicourse.com

This course is available immediately. Please contact us at avaicourse17@gmail.com with the best service for more detailed advice.

Description:

THIS OPTION SPREADS COURSE COVERS THREE (3) ADVANCED OPTIONS STRATEGIES – BACKSPREADS, DIAGONALS AND BUTTERFLY SPREADS

SECTION I – BACKSPREADS AND RATIO SPREADS

Back Spread and Ratio Spreads involve putting on an unbalanced amount of Long and Short Options. If we have more Long Options than Short, the position is called a Back Spread and if we have more Short Options than Long, the position is called a Ratio Spread. In a Ratio spread, you have unlimited losses on one side because you have more Short Options. The Back Spread is part of the BUSY PROFESSIONAL SERIES can be constructed in many creative ways, and we show you how you can manage different strike prices as well as different ratios of Long and Short Options to construct an optimal Back Option Spreads. We don’t recommend Ratio spreads as they have an unlimited loss potential.

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:BWT Precision 7.0.2.3 (AutoTrader + Indicators +

Course Features

- Lectures 0

- Quizzes 0

- Duration 50 hours

- Skill level All levels

- Language English

- Students 0

- Assessments Yes