Dan Sheridan 2011 Calendar Workshop

Download Dan Sheridan 2011 Calendar Workshop on Avaicourse.com

This course is available immediately. Please contact us at [email protected] with the best service for more detailed advice.

Description:

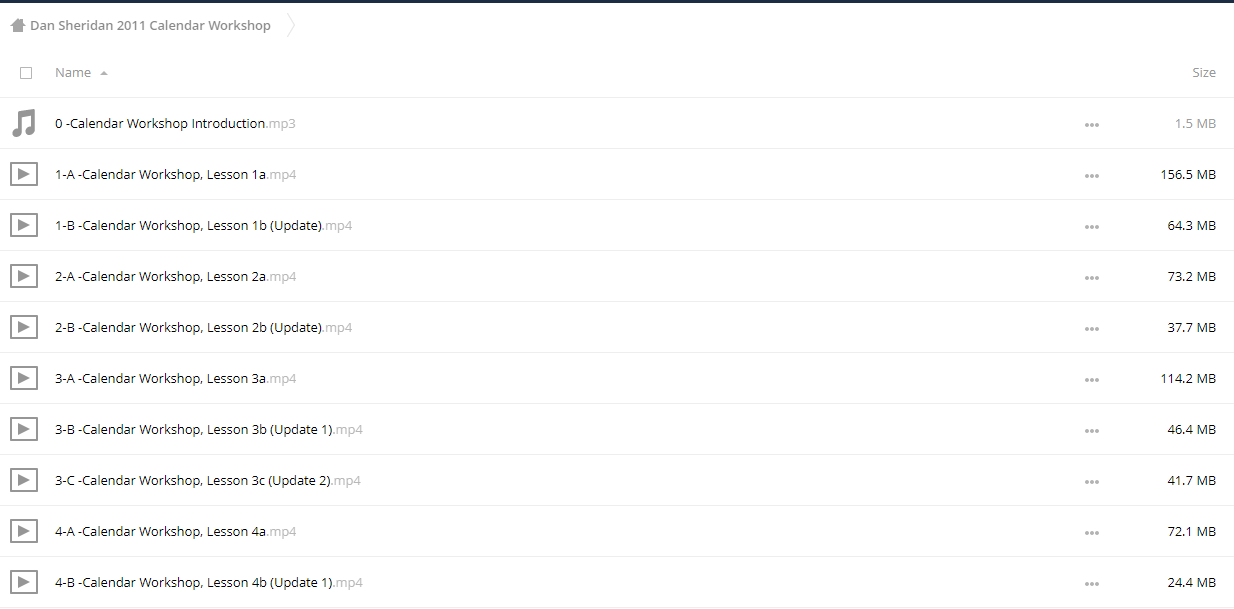

Calendar Workshop (in MP4 Video Format high quality)

May2011 to June 2011 Live Webinar with Live Trade from Dan Sheridan

Dan taught a new five week class that focused on sharpening your skill as a Calendar trader. He put on 8-10 calendar paper trades in the class on different vehicles.

This class gives you the opportunity to combine practical experience with your knowledge of calendars. Different Calendars such as Campaign, Guerilla, Double and Triple Calendars will be traded. Simple risk management approaches with no adjustments as well as approaches with adjustments were covered.

Each class averaged 2 hours. You’ll be getting almost 16 hours of extremely focused and useful information that you can use forever. It’s the difference between an advisory service giving you the fish versus learning to fish for yourself!

Dan Sheridan, 22 year CBOE Options Market Maker, taught professional PIT traders for years and now is going to teach you the same strategies and techniques used by professional traders for years! See what’s inside this new course:

Features

NEW: Dan put several trades on each week and did LIVE updates in-between classes so you can follow Dan’s analysis and adjustments to each trade.

You can access the recorded materials indefinitely

You can access any future live classes for this course!

You can apply this class fee towards our premium mentoring program for one full year!

Class Overview WEEK ONE (2 hours 6 minutes)

Running an Options Business

Why Do Calendars?

Greek characteristics of Calendars

Finding Calendar candidates

VIPES-Process for filtering candidates

Making a plan

Go fishing! Dan put on a live trade for execution purposes

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Dan Kennedy – Copywriting Mastery & Sales Thinking

Course Features

- Lectures 0

- Quizzes 0

- Duration 50 hours

- Skill level All levels

- Language English

- Students 0

- Assessments Yes