Trading refers to the buying and selling of financial instruments, such as stocks, bonds, commodities, currencies, and derivatives, with the aim of making a profit. It is a fundamental economic activity that has been practiced throughout history, evolving from traditional open outcry methods in physical exchanges to modern electronic trading platforms.

There are various types of trading strategies and styles, and traders may engage in different timeframes, such as day trading, swing trading, or long-term investing. The motivation behind trading can vary, with some individuals and institutions seeking short-term profits based on market fluctuations, while others may focus on long-term investment strategies to build wealth over time.

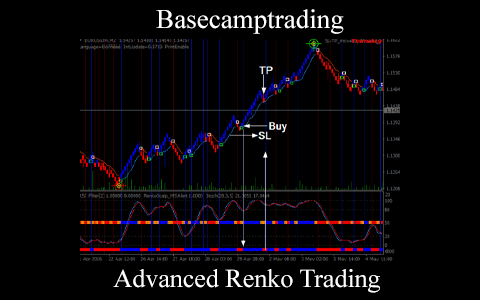

Key components of trading include market analysis, risk management, and decision-making. Traders often use technical analysis, fundamental analysis, or a combination of both to assess market conditions and make informed decisions. Risk management involves strategies to minimize potential losses, while decision-making includes executing trades based on analysis and market conditions.

It’s important to note that trading involves inherent risks, and individuals should have a clear understanding of the markets, relevant instruments, and risk management principles before engaging in trading activities. Additionally, financial markets are regulated, and traders need to adhere to rules and regulations established by relevant authorities.

Salepage: Basecamptrading – The Ultimate Beginner’s Guide to Trading

More courses from this author: Basecamptrading

Course Features

- Lectures 1

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 0

- Assessments Yes