Cease the quest for the Holy Grail trading system!

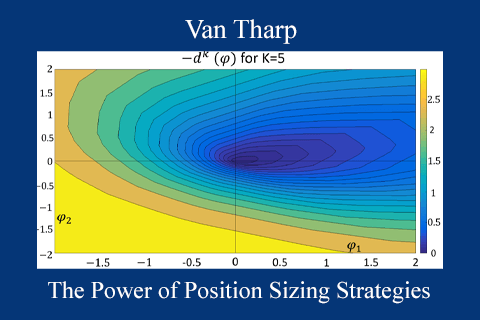

The comprehension of the SQN score’s interpretation for your trading systems enables the formulation of position sizing strategies for trading systems deemed “satisfactory,” facilitating the achievement of trading goals! A necessity for those seeking enhancement in their trading through Van Tharp’s Position Sizing Strategies!

What will be acquired:

- Recognition of the characteristics of sound objectives.

- Understanding of the computation and application of the SQN score to trading systems.

- Identification of position sizing strategies suitable for both your objectives and systems.

- Mastery of the utilization of various Microsoft Excel-based tools, including a Monte Carlo simulator, for minimizing uncertainties related to selected strategies.

What are the three fundamental elements to be cognizant of?

- Your Trading Objectives.

Are they documented? Are they comprehensive? Do they align with your persona? Do they govern every aspect of your trading endeavors? 2. Your Trading System Performance.

Do you possess performance metrics categorized by market type for each trading system? Have you chosen your current systems based on defined criteria? Do you monitor your systems’ performance to ensure they generate anticipated results and exhibit the expected “behavior”? 3. Your Position Sizing Strategies.

The pivotal connection between your trading objectives and your trading system is formed by your position sizing strategies. These strategies are meticulously crafted to assist in achieving your objectives and serve as the primary catalysts for aligning your trading with your goals.

More courses from this author: Van Tharp

Course Features

- Lectures 1

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 0

- Assessments Yes