Trading refers to the act of buying and selling financial instruments, such as stocks, bonds, commodities, or currencies, with the goal of making a profit. It is a fundamental economic concept that has been in practice for centuries, evolving over time with advances in technology and globalization.

Traders can be individuals or institutions, and they engage in trading for various reasons, including speculation, hedging against potential losses, or as a means of earning a living. Trading can take place on different platforms, including stock exchanges, commodity exchanges, and foreign exchange markets. Here are some key aspects of trading:

- Financial Instruments: Trading involves various financial instruments, including stocks (equity), bonds, commodities (like gold, oil), currencies (forex), derivatives (options, futures contracts), and more. Different markets have different instruments.

- Buy and Sell: Traders buy these instruments at a lower price with the anticipation that their value will increase, allowing them to sell at a higher price. Conversely, traders can also sell an instrument they don’t own (short selling) with the hope of buying it back at a lower price.

- Market Participants: Participants in the market include individual retail traders, institutional investors (like mutual funds and pension funds), and market makers who facilitate trading by providing liquidity.

- Risk and Reward: Trading involves risk. Prices can fluctuate due to various factors like economic indicators, geopolitical events, market sentiment, etc. Traders use different strategies and analyses to predict price movements and manage risks.

- Types of Trading: There are various trading styles, such as day trading (buying and selling within the same day), swing trading (holding positions for several days or weeks), and long-term investing (holding investments for years). Each style has its own risk and reward profile.

- Electronic Trading: With the advancement of technology, a significant portion of trading occurs electronically, where traders can execute trades through computer networks. This has increased the speed and efficiency of trading activities.

- Regulation: Trading activities are regulated by financial regulatory authorities in most countries to ensure fairness, transparency, and investor protection.

It’s important for individuals interested in trading to educate themselves thoroughly, understand the risks involved, and consider seeking advice from financial professionals. Trading can be profitable, but it requires knowledge, discipline, and a well-thought-out strategy.

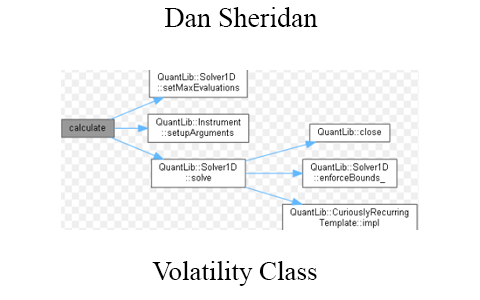

More courses from this author: Dan Sheridan

Screenshot:

Course Features

- Lectures 1

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Language English

- Students 0

- Assessments Yes