Jeffrey Kennedy – How to Capitalize on Volatile Markets Like These

Download Jeffrey Kennedy – How to Capitalize on Volatile Markets Like These on Avaicourse.com

This course is available immediately. Please contact us at [email protected] with the best service for more detailed advice.

Description:

We originally delivered these 6 lessons to our Trader’s Classroom students in real time, as global markets collapsed. Now you get these 75 minutes of insights as our Trader’s Classroom Essential Series.

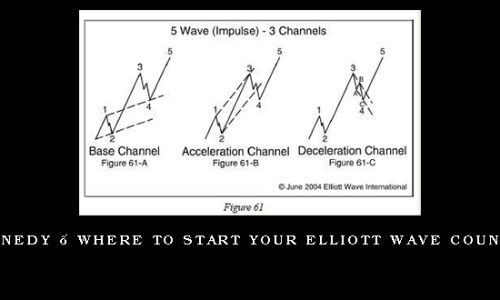

The chart setups you’ll see in these 6 lessons are particularly useful in highly volatile markets, when moves that normally take days get to their targets in minutes.

You’ll learn an objective, calm approach so you can take advantage of the big swings — without getting in trouble with your emotions.

You can use these setups on any time frame, in any market — and in either direction.

Yes, these setups are occurring right now, in this market environment.

HOW TO WATCH THE 6 VIDEOS NOW

OFFER 1: GREAT DEAL

$79

“How to Capitalize on Volatile Markets Series”

OR

OFFER 2: BEST DEAL

(YOU SAVE 51%)

$156 $77

6 “How to Capitalize on Volatile Markets Series” Videos

+

30 days of Trader’s Classroom, delivering real-time setups and strategies 3 times a week

How to Capitalize on Volatility

Without Emotion

When you look at the markets today, it’s very hard to stay unemotional.

Even the volatility itself is volatile. You’ll have several days of relative calm, and then wham — the moves are suddenly huge, and it’s time to jump in!

But you have to be ready.

These 6 videos teach you chart setups that are particularly well-suited to volatile markets.

After watching, you’ll gain the skills you need to manage your risk, set objective targets, and know when to get out.

So you can develop an unemotional, objective, calm, reasonable, sleep-at-night volatility plan.

AFTER OUR 40 YEARS IN THE BUSINESS, WE KNOW THIS:

Fear and hope go away when you know exactly what chart setups to look for.

When you know precisely how long you should stay aboard a move, and when to calmly jump out.

When you have objectively set risk levels based on price patterns — so if you’re wrong, you know it fast, with minimal losses.

And then, when your risk is tight, your target is clear and the pattern is high-confidence, only then…

You strike.

THESE 6 VIDEOS WILL HELP YOU DEVELOP YOUR

OBJECTIVE, CALM, SLEEP-AT-NIGHT VOLATILITY PLAN

The 6 videos you’re about to watch were recorded by 4 of our veteran market analysts with 120 years of combined experience between them. They’ve seen markets like these. A lot.

We are a big team with deep experience from pro desks across the financial industry.

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:The 2012 Social Mood Conference

Course Features

- Lectures 0

- Quizzes 0

- Duration 10 weeks

- Skill level All levels

- Students 0

- Assessments Yes