Volume Breakout Indicator

Download Volume Breakout Indicator on Avaicourse.com

This course is available immediately. Please contact us at [email protected] with the best service for more detailed advice.

Description:

Summary

This breakout indicator will detect directional breakouts on high volume. It analyzes the chart to find the times of day when volume and volatility are highest. For major forex pairs this normally coincides with the open of the London market. For commodities it’s usually the start of New York’s trading session.

The indicator will create a buy signal or a sell signal whenever a breakout event is detected during this period. The event time can also be overridden manually.

Example uses:

Detecting breakouts at the open of London, Tokyo or New York trading sessions

Trading breakouts on economic data, monetary policy statements and other news

Trading breakouts at any regular time interval

Analyzing market behavior and hourly volume/volatility

Directional Breakouts at Peak Volume

Breakout strategies suffer when there are a high proportion of false breaks. Instead of trading on every potential breakout, this indicator looks for the highest probability cases only. The strongest breakout events often happen when volume is rising sharply. These events are often around the opening of the major markets such as London, Tokyo and New York.

Get Volume Breakout Indicator on Salaedu.com

The indicator works as follows:

On loading it will check the price history to find times of peak daily volumes.

Displays the estimated peak volumes for each hour of the day

Monitors price movements before and immediately after the peak volume time.

Creates buy and sell alerts when a breakout has been detected.

This indicator only trades at one specific time of day – the time when volume and volatility is increasing sharply and where breakout events are usually strongest. This breakout strategy is designed for short duration trades only – day trades. The ideal timeframes are 5 minutes to 30 minutes.

Peak Volume

There aren’t any direct volume metrics available for foreign exchange. For this reason the indicator uses volatility analysis to predict times of day when volume is increasing or decreasing.

The graphic below shows volumes for the forex majors over a 24 hour period.

Figure 5: Peak volume analysis © forexop

Instead of having the indicator automatically detect peak volumes you can also manually override this and set any time to monitor. For example, this can be useful when trading breakouts on economic data releases.

For examples of volume breakout strategies see this page.

Figure 6: EURUSD 5M placing trades on indicator output signals © forexop

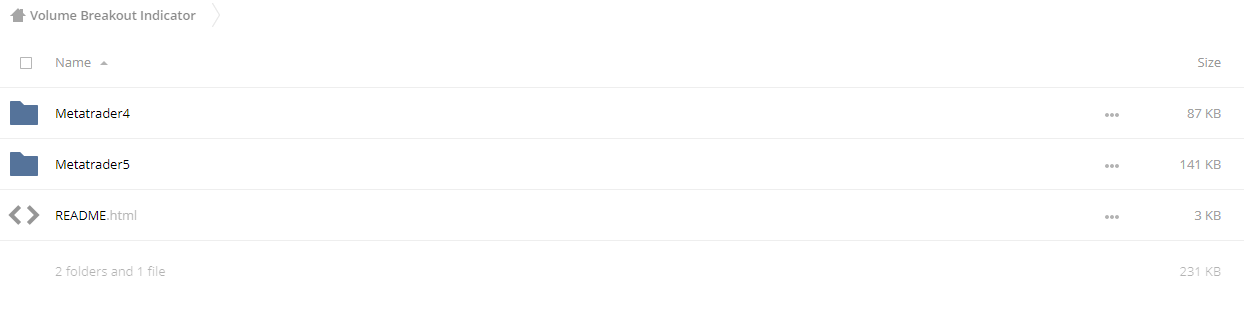

Compatible with Metatrader 4 and Metatrader 5.

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Trader-Dante.com – Special Webinars Module 1

Course Features

- Lectures 0

- Quizzes 0

- Duration 50 hours

- Skill level All levels

- Language English

- Students 0

- Assessments Yes