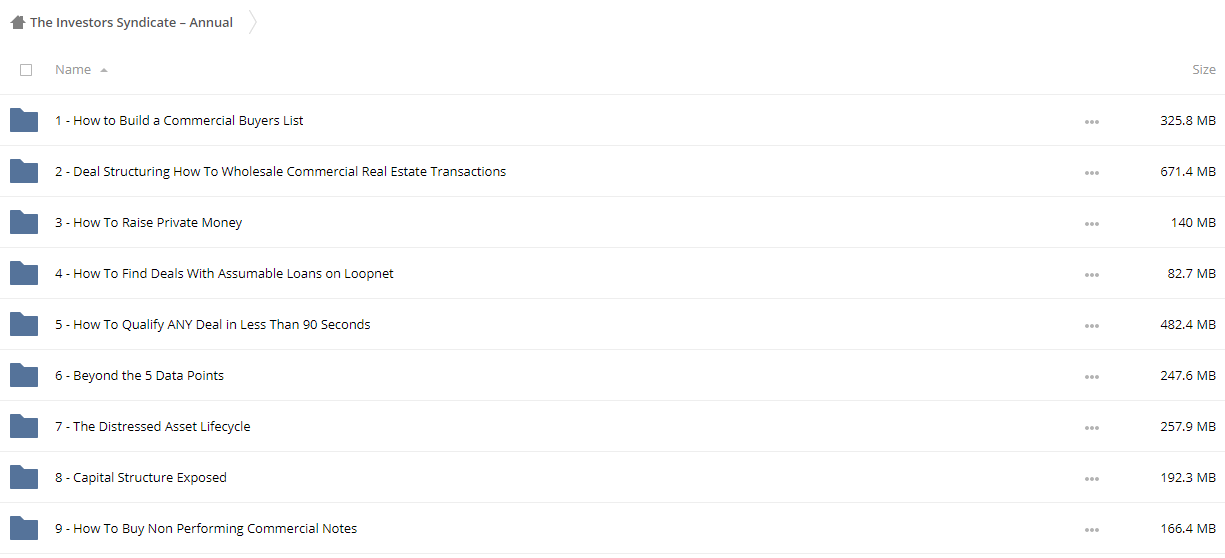

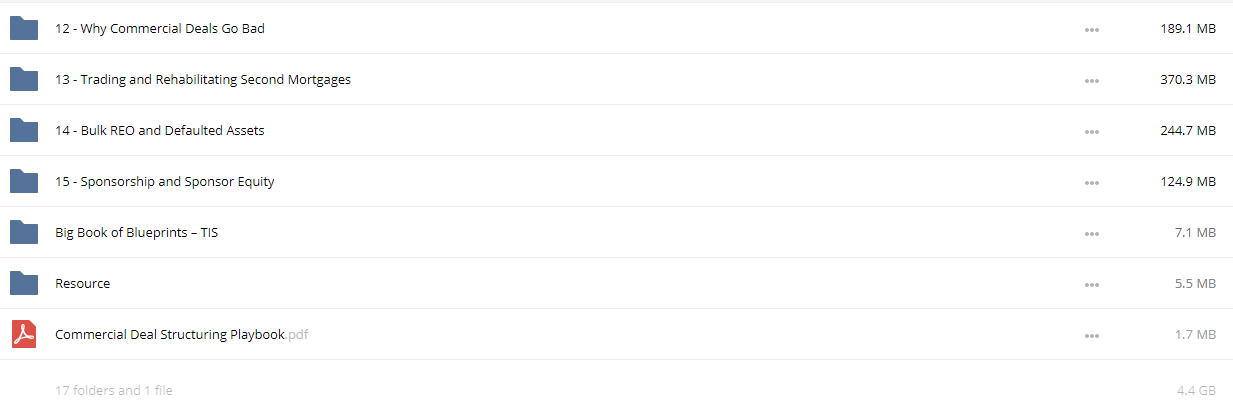

The Investors Syndicate – Annual

Download The Investors Syndicate – Annual on Avaicourse.com

This course is available immediately. Please contact us at avaicourse17@gmail.com with the best service for more detailed advice.

Description:

- Easily raise the capital needed to do 7 and 8 figure deals?

- Swoop in and take control of distressed offices or multifamily buildings?

- Flip high dollar deals for massive profits, without ever using a dime of your own money?

- Residential is WAY more competitive.

- Thinner deal margins.

- Residential investors are shackled at the ankles with federal rules and regulations.

- It’s much easier to raise capital for commercial deals than for residential ones.

- Residential is a much more hostile environment.

- Scalability.

- The belief that residential investing involves less hassle, less time invested, and less paperwork is flat out WRONG!

- Doing deals in residential : a challenging federally regulated and constricting environment where you tie up your cash for months on end, thus limiting the number of deals you do with just a mediocre payoff…

- Or in commercial : wisely building a viable high fee, high margin, high cashflow, high profit business while at the same time creating true long term wealth?

- Owners are behind on payments…

- The property is in foreclosure or bankruptcy…

- It’s an REO at the bank…

- Repairs are needed to get the building back to black…

- Sponsors are silently crying for bridge financing as their loans come due…

- Owners have no clue how to raise capital to complete the project…

- $1 Million (or more) is needed to close the deal…

- Banks are holding the defaulted note and need to get it off their books…

- Partners want to be taken out of the deal… IMMEDIATELY, IF NOT SOONER…

- Loans need to be paid off because they’re due or past due…

- Professional Network

- Intellectual capital

- Training and experience

And Expert Network Center

You guessed it… Bad information!

- The stuff that actually WORKS!

- The stuff that builds your business!

- The stuff that puts money in the bank!

- The stuff grows your wealth for years to come!

- Capital Formation: How to Raise Capital ON DEMAND for your deals

- Asset Arbitrage: What the institutional players call “wholesaling” deals

- Deal Making and Gamesmanship: Matching capital with the asset

- Capital Placement: Placing capital from Wall Street firms into YOUR deals

- Highly Paid Consulting: High Paid or Highly Feed? Your choice…

- Deal Structuring: Profit big time by creating solutions when no one else can

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Rob Swanson – Handwritten Postcard System

Course Features

- Lectures 0

- Quizzes 0

- Duration 50 hours

- Skill level All levels

- Language English

- Students 0

- Assessments Yes