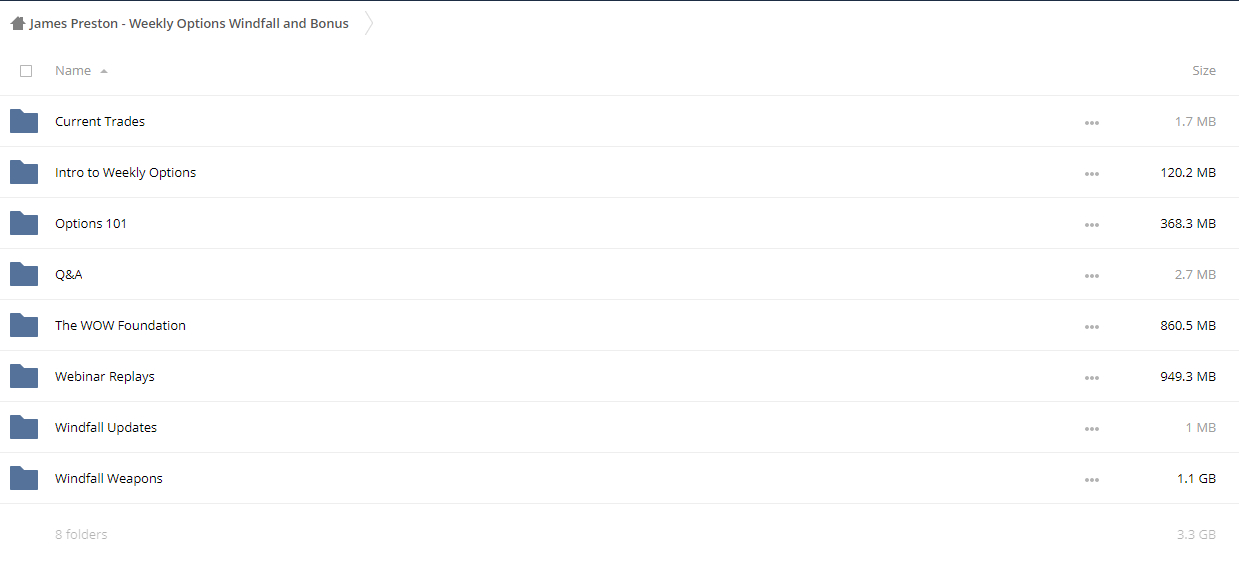

James Preston – Weekly Options Windfall and Bonus

Download James Preston – Weekly Options Windfall and Bonus on Avaicourse.com

This course is available immediately. Please contact us at [email protected] with the best service for more detailed advice.

Description:

“Bring It On!”

Whether It’s More Bail-outs, Quantitative Easing, Money-Printing Running 24-7, Inflation, or China Calling Our Debt Due-I Don’t Care…

I’m Making More Money Now Than I EVER Have In My Entire 19-Years of Trading For a Living

Read This Message and I’ll Tell You Exactly How I’m Doing It…

It started just over 3 years ago. Weekly options contracts were introduced. And since then, a LOT has changed in the way I approach the market these days.

And these changes are giving me fresh, new opportunities and circumstances that have NEVER been available to the small, independent trader before (tmestors like you and me).

And over the last 36 months. I’ve experimented with and proven several brand-new strategies that you can use to profit consistently with weekly options… and get this:

They work EVEN BETTER In a volatile market like RIGHT NOW.

In fact, there’s no better time titan now to use these strategies. And quite frankly – like it or not – this market volatility could be the “new normal” for us for years to come.

The truth is – things have changed DRAMATICALLY over the last 5 years. There’s an entire shift happening… an “undertow” – if you will – tltat lias completely changed the foundation of what the stock market is. how it operates, and why things that used to work just flat-out DON’T work anymore.

It’s time for a re-frame of your brain – an awakening of sorts.

I’m about to show you how this change is unearthing MASSIVE opportunities right now. And for those who embrace it and go with it – there will be profit waves to ride for the rest of your life.

What’s going on out there?

The shift that’s been taking place in the market (with no end in sight/ is this:

There’s a Massive Increase in the Amount of Institutional Trading That’s Going On

“Institutions” are entities such as: Wall Street investment banks, brokerage houses, foreign banks and funds, hedge funds, mutual funds, publicly traded companies (¡ike the nnestments Microsoft makes), insurance companies, pension funds, large foundations, even the Federal Reserve!

According to TriinTabs Investment Research, in 2010 institutional trading comprises just over three-quarters of Al l stock market volume! (Just S years ago. it wti approximately 2/irds of alt stock market activity).

At this rate – it doesn’t look like this trend is slowing down or stopping any time soon. Some experts I’ve interviewed lately say this means curtains for the regular investor out there. Certain doom

But for me. I’m excited as hell!

Why?

Because this kind of fundamental shift – and the consequent radical change in the market – means there are NEW WAYS to capitalize… and do it in quantum leaps!

As far as I’m concerned “out-with-the-old and in-with-the-new” is just fine with me. Btit tlte prizes will only be tossed out to those who know where to move and how to act.

Quite honestly…

If It Weren’t For the New Weekly Options I Honestly Don’t Think I Could Have Made Money In This Obama-Driven Economic Mess!

So bottom line… xvhat does this all mean in the real world, if institutions arc now 3 4’s of all trading volume?

In a nutshell, It means more concentrated power is being wielded around by fewer sources. And it

leaves bigger, heavier tracks out there.

I don’t know about you. but trends to me don’t feel like tiiey used to.

1 know that we’ve had some very unusual years lately… but still, you can just tell things have changed.

Also, it used to matter a great deal if you put in the time, did your research, w ere disciplined, follow ed rules, etc . more than the next guy.

But now it feels like stocks get hyper carried away – in either direction – your fundamental and technical research be damned!

This takes me back to an interview I did a few months ago with Gregory Zuckermnn. author of the bestselling book ‘ The Greatest Trade Ever”.

Zuckermnn interviewed John Paulson for over 100 hours, the hedge fund manager who pocketed close to SI5 billion on ONE trade that spanned approx IS mouths. He also interviewed 50 friends, close associates and traders in his fluid.

From all this. Zuckermnn believes we’ve entered a permanent “bubble state” – füll of lazy, copycat hedge fund managers who pay lip service to doing research.

He says that based on the way these managers are compensated (they make mountains of money Just being average’) that it’s just far easier to be a copycat of what another hedge hind manager is doing.

And that’s how MOST of these funds make their decisions… based on what tlie other guy did in his hind.

No digging no hard work… no research, they just watch the volume of the other funds’ action and hop onboard.

Think of it like this: it’s like a bathtub full of water. When you sit down in the tub and push the water back and forth, it makes the water start to move the same direction, Well, these guys all hop in the same bathtub – they make the stock market bath water swish back and forth.

And it inevitably causes bubbles (not bubbles from the bubble bath, but bubbles in price’)

Forex Trading – Foreign Exchange Course

Want to learn about Forex?

Foreign exchange, or forex, is the conversion of one country’s currency into another.

In a free economy, a country’s currency is valued according to the laws of supply and demand.

In other words, a currency’s value can be pegged to another country’s currency, such as the U.S. dollar, or even to a basket of currencies.

A country’s currency value may also be set by the country’s government.

However, most countries float their currencies freely against those of other countries, which keeps them in constant fluctuation.

More Course: FOREX TRADING

Outstanding Course:Yuri Shramenko – Trading Forecasts Manual

Course Features

- Lectures 0

- Quizzes 0

- Duration 50 hours

- Skill level All levels

- Language English

- Students 0

- Assessments Yes